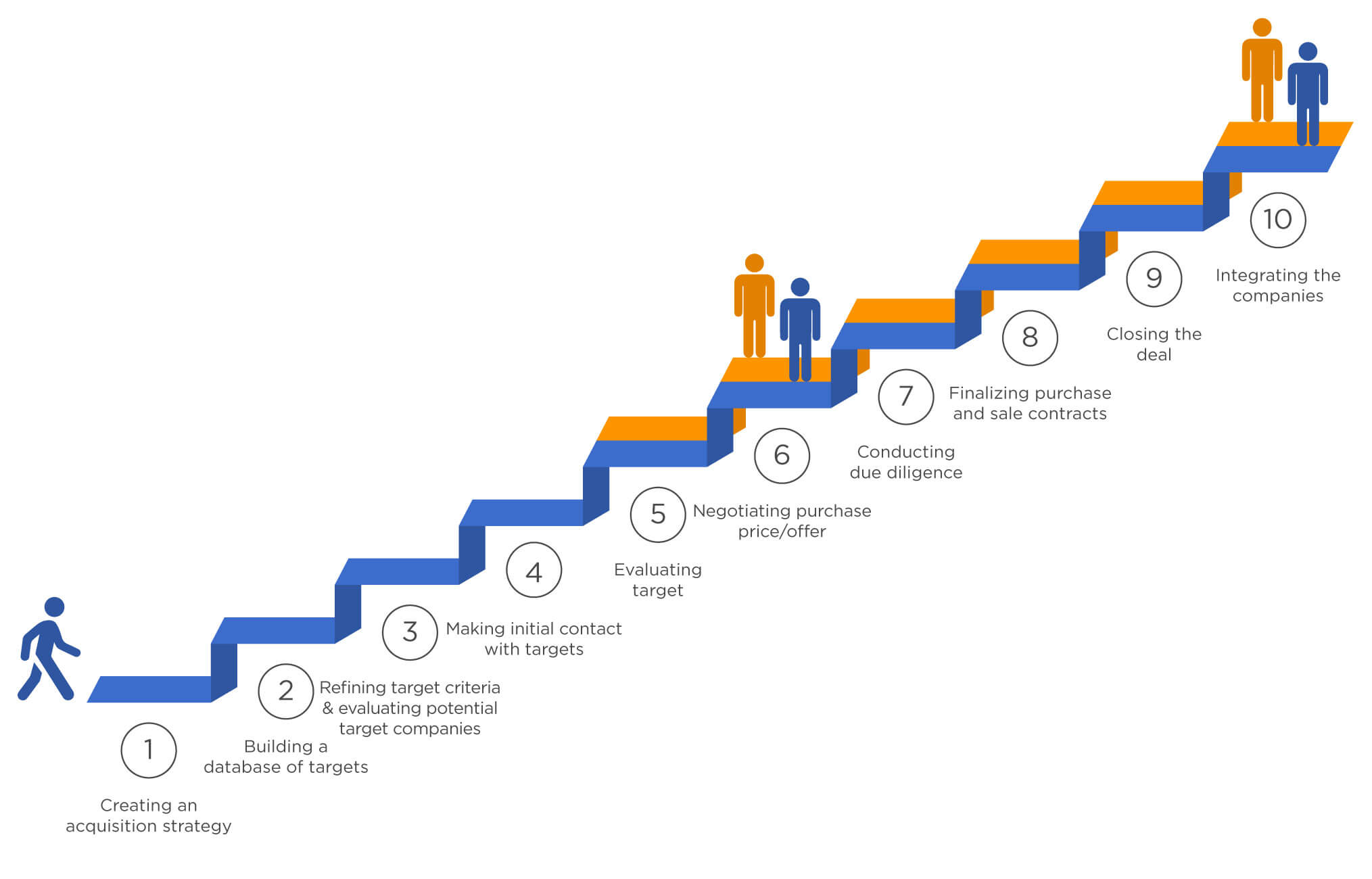

6 Steps to a Successful Merger and Acquisition:

Mergers and acquisitions (M&A) can be powerful strategies for businesses looking to grow, expand into new markets, or gain a competitive edge. However, the success of an M&A deal depends on careful planning, execution, and integration.

It is crucial for organizations to follow a structured approach to ensure a smooth and successful merger or acquisition. In this article, we will outline six essential steps to guide you toward a successful M&A process.

Define Clear Objectives and Strategy:

Before embarking on an M&A deal, it is important to define clear objectives and a strategic rationale. Identify the reasons behind the merger or acquisition, whether it is to access new markets, acquire key technologies, diversify product offerings, or gain operational synergies.

Clearly articulating the strategic goals will guide the decision-making process throughout the M&A journey. Conduct a thorough analysis of the target company or companies to ensure alignment with your organization's strategic direction.

Assess their financial health, market position, intellectual property, customer base, and cultural fit. This evaluation will help you determine if the potential deal aligns with your strategic objectives.

Conduct Due Diligence:

Due diligence is a critical step in the M&A process. It involves conducting a comprehensive assessment of the target company's operations, financials, legal contracts, intellectual property, and potential risks.

Engage legal, financial, and operational experts to conduct due diligence and identify any potential issues or challenges that may impact the success of the deal. Thorough due diligence provides valuable insights into the target company's assets, liabilities, growth prospects, and potential synergies.

It helps you make informed decisions and negotiate favorable terms during the deal-making process.

Develop an Integration Plan:

A well-thought-out integration plan is crucial for a successful M&A. Start by assembling a cross-functional integration team that includes representatives from both the acquiring and target companies.

Define clear roles and responsibilities, and establish effective communication channels to ensure smooth collaboration. Develop a detailed integration plan that addresses key areas such as technology integration, organizational structure, employee retention, cultural integration, and customer transition.

Identify potential challenges and devise strategies to mitigate risks. A comprehensive integration plan ensures a seamless transition and minimizes disruptions to operations.

Communicate Effectively:

Open and transparent communication is essential throughout the M&A process. Communicate the strategic rationale and benefits of the merger or acquisition to key stakeholders, including employees, customers, suppliers, and investors.

Address their concerns and provide regular updates to maintain trust and alleviate uncertainties. Develop a comprehensive communication plan that outlines key messages, channels, and timelines.

Keep employees informed about any changes that may impact their roles, responsibilities, or job security. Engage in proactive and ongoing communication to ensure a smooth transition and maintain stakeholder confidence.

Execute Integration with Precision:

Executing the integration plan with precision is crucial for a successful merger or acquisition. Coordinate activities across departments, establish key performance metrics, and monitor progress regularly. Assign integration leaders responsible for different functional areas to ensure accountability and alignment.

Prioritize integration activities based on their strategic importance and potential impact on the business. Consider the cultural aspects of the two organizations and develop strategies to integrate and align company cultures. Engage employees from both organizations in the integration process to foster collaboration and create a sense of ownership.

Evaluate and Adjust:

Post-merger or acquisition, it is important to evaluate the progress and success of the integration efforts. Assess the achievement of predefined goals and objectives, review financial performance, and evaluate customer satisfaction and employee engagement.

Identify any gaps or areas for improvement and adjust the integration strategy as needed. Address any cultural or operational challenges that may arise during the integration process. Continuously monitor performance, learn from the experience, and implement corrective measures to optimize the long-term success of the merged entity.

conclusion:

In conclusion, a successful merger or acquisition requires careful planning, thorough due diligence, effective communication, precise execution, and ongoing evaluation. By following these six essential steps, organizations can navigate the complexities of the M&A process and increase the likelihood of a successful outcome.

Mergers and acquisitions, when approached strategically and executed with precision, can be transformative opportunities that drive growth and deliver significant value to the organizations involved.

0 Comments